Tariffs Threaten to Push Auto Insurance Rates Even Higher

As the global economy continues to experience fluctuations due to various factors, one of the most pressing concerns for auto owners and consumers alike is the impact of tariffs on auto insurance rates. The latest reports indicate that escalating tariffs may lead to a significant increase in insurance costs. This article delves into the mechanics of how tariffs influence auto insurance rates, the potential effects on consumers, and what can be done to mitigate these impacts.

Understanding Tariffs and Their Impact

Tariffs are taxes imposed on imported goods, and they serve as a mechanism for governments to protect domestic industries from foreign competition. In recent years, the United States has implemented various tariffs on steel, aluminum, and automotive parts. These tariffs have a cascading effect on the auto industry, which, in turn, affects consumers’ auto insurance rates.

How Tariffs Affect the Auto Industry

The impact of tariffs on the auto industry can be summarized as follows:

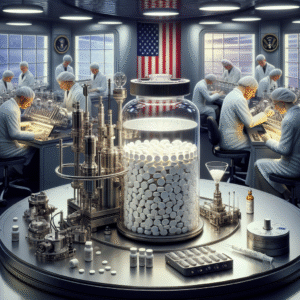

1. Increased Production Costs: Manufacturers face higher costs for raw materials due to tariffs on imported steel and aluminum. This often leads to increased prices for vehicles.

2. Higher Repair Costs: If the costs of parts used in auto repairs rise, repair shops may pass these costs onto consumers, leading to higher insurance premiums.

3. Market Instability: Uncertainty in trade policies can lead to market instability, causing fluctuations in vehicle prices and repair costs, which are significant factors in determining insurance rates.

The Connection Between Auto Insurance Rates and Vehicle Costs

Auto insurance rates are closely linked to the cost of vehicles. When vehicle prices increase due to tariffs, insurance companies adjust their premiums to account for the higher replacement costs. Here’s how it works:

– Total Loss Valuation: Insurance companies base their premiums on the value of the car. If the value increases due to higher production costs, premiums are likely to follow suit.

– Repair Costs: Higher repair costs from inflation in parts and labor can lead to more significant claims. Insurers may raise premiums to cover these potential increases.

– Loss Ratios: Insurers analyze data on claims relative to premiums collected, known as loss ratios. If loss ratios increase due to higher claims costs, insurers may adjust rates accordingly.

Potential Rate Increases

Experts predict that auto insurance rates could increase by as much as 10% to 20% over the next few years if tariffs remain in place. This increase is especially concerning for consumers who are already facing numerous financial pressures in a post-pandemic economy.

Consumer Impact

The potential increase in auto insurance rates due to tariffs can have far-reaching implications for consumers:

1. Budget Strain: Many families are already struggling with rising costs of living. Increased insurance rates could create additional financial strain, forcing consumers to make difficult choices about their budgets.

2. Vehicle Ownership Decisions: Higher insurance costs might lead some individuals to reconsider their vehicle ownership, potentially pushing them toward cheaper, older cars that may come with their own risks.

3. Increased Uninsured Motorists: As insurance becomes more expensive, some drivers may opt to forego coverage altogether, which could lead to a rise in uninsured motorists on the roads, further exacerbating the issue for insured drivers.

Mitigating the Impact of Tariffs on Auto Insurance Rates

While the situation appears daunting, there are strategies consumers can employ to mitigate the impact of rising auto insurance rates:

Shop Around for Insurance

– Consumers should regularly compare quotes from different insurance providers. Shopping around can uncover significant savings and ensure that drivers are getting the best deal.

Bundle Your Policies

– Many insurance companies offer discounts for bundling auto insurance with other policies, such as home or renters insurance. This can lead to substantial savings.

Increase Deductibles

– Opting for higher deductibles can lower monthly premiums. However, consumers should ensure they can afford the deductible amount in the event of a claim.

Maintain a Clean Driving Record

– Safe driving can lead to lower premiums over time. Insurance companies often reward drivers with clean records with discounts.

The Road Ahead

As the auto industry navigates the challenges posed by tariffs, consumers must stay informed about how these changes can impact their auto insurance rates. Understanding the connection between tariffs and insurance costs is vital for making educated financial decisions.

The ongoing negotiations surrounding trade policies will undoubtedly play a crucial role in determining the future landscape of the auto industry and the insurance market. As consumers, advocating for fair trade practices and supporting policies that protect both the industry and the consumer will be essential in mitigating the impact of tariffs.

In conclusion, while tariffs present a challenge for auto insurance rates, being proactive and informed can help consumers navigate the complexities of this evolving landscape. Whether through shopping for better rates, understanding the implications of tariffs, or taking steps to lower individual costs, consumers have the power to influence their financial outcomes in the face of rising insurance premiums.